Events & Webinars

Taskize recently attended the 33rd edition of IMpower incorporating FundForum – the largest global asset and wealth management conference.

Taskize recently attended the 33rd edition of IMpower incorporating FundForum – the largest global asset and wealth management conference.

Our team spent a productive few days engaging with asset and wealth managers to highlight the value of the Taskize platform and delve into emerging trends within the sector. Here are our key insights from the sessions we attended.

1. Geopolitics and new investment opportunities

- Investors need to explore alternative investments to mitigate risk

- Questions were raised about the potential revival of bond markets amidst high interest rates

- HSBC’s significant overweight in the US, followed by Asia, and continued investment growth in India

- Private banks are increasingly emphasising private markets and alternative investments, though private debt poses a notable risk

2. Global challenges and private markets

The discussion revolved around how private markets are adapting to global challenges to support private wealth investors and stimulate capital market investments worldwide.

3. Innovation in operations: Tech, AI, and data

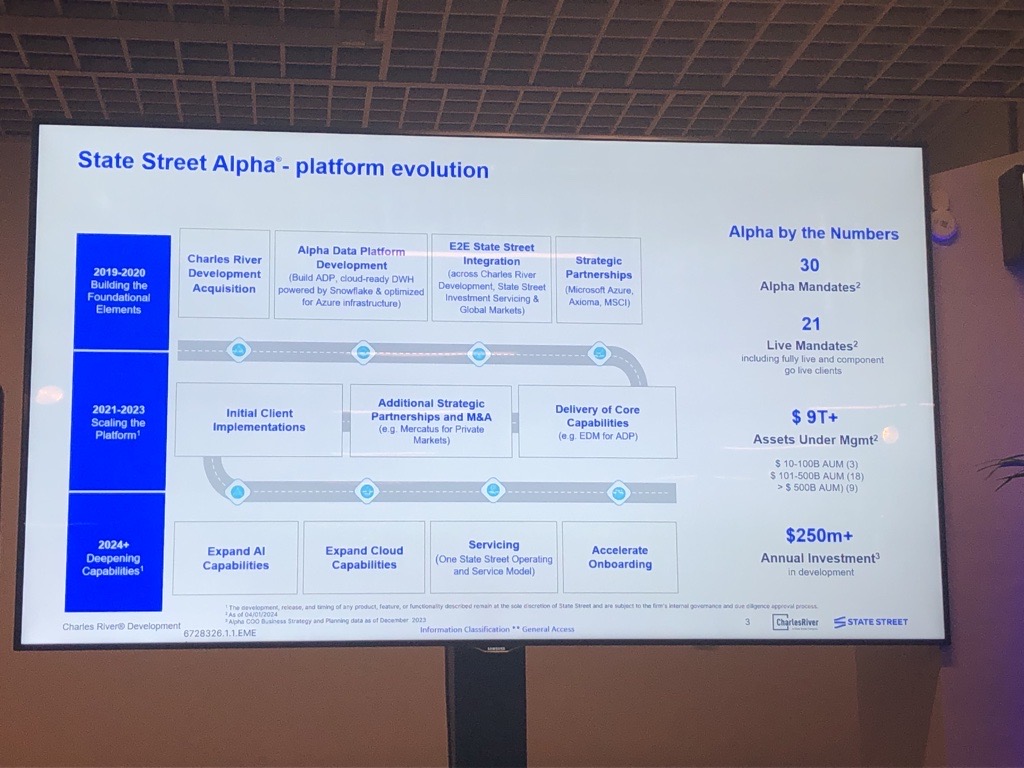

A standout session focused on four transformative ideas for business operating models, with a highlight presentation by Ewan Scott, Head of Alpha Technology Platform EMEA at State Street. Scott introduced Alpha – the industry’s first front-to-back, public-to-private technology and servicing solution. Key takeaways included:

- Adoption and impact: 30 asset management firms have adopted Alpha, which helps flag exceptions and improve data quality through refined rules

- AI integration: State Street employs 400 individuals in AI development, aiming to trial new solutions with clients once legal frameworks are in place

- Challenges: Addressing false positives and handling unstructured private market data, often found in PDFs, remains a significant hurdle

This fireside chat with leading COOs focused on establishing robust processes and standards across operations to minimise risk. Highlights from the conversation:

- Current market conditions have placed risk management at the forefront

- Increased outsourcing risks have attracted regulatory attention, emphasising personal accountability for investment managers over fund administrators

- Planning for the short term and being aware of the long term is the way the COOs should look to resolve risk

- Smaller businesses face a delicate balance between leveraging technology and maintaining human oversight to meet client needs. Also, new regulations are challenging the viability of smaller businesses, potentially reducing their numbers in the market.

5. The optimal outsourcing equation

The final session we wanted to highlight delved into the complexities of outsourcing, focusing on balancing cost savings with service quality:

- The importance of contract length and vendor culture in outsourcing decisions was emphasised – some investment banks are seeing seven to ten years contracts but what you need now may not be what you need in eight years

- It’s very important to also look at the culture of vendors – Do people enjoy working there? Is there a high turnover of staff?

- You can outsource the ‘doing’ but not the responsibility.

In summary, the insights from the FundForum highlight the dynamic nature of the asset and wealth management industry. As the sector navigates geopolitical tensions, technological advancements, and regulatory changes, platforms like Taskize are increasingly vital in providing solutions that address these evolving challenges.

Tara and Simon celebrating the end of a great event!