Insights

Shaping the Future of Funds: Taskize at FundsCo 2025

Read the key trends shaping the future of funds

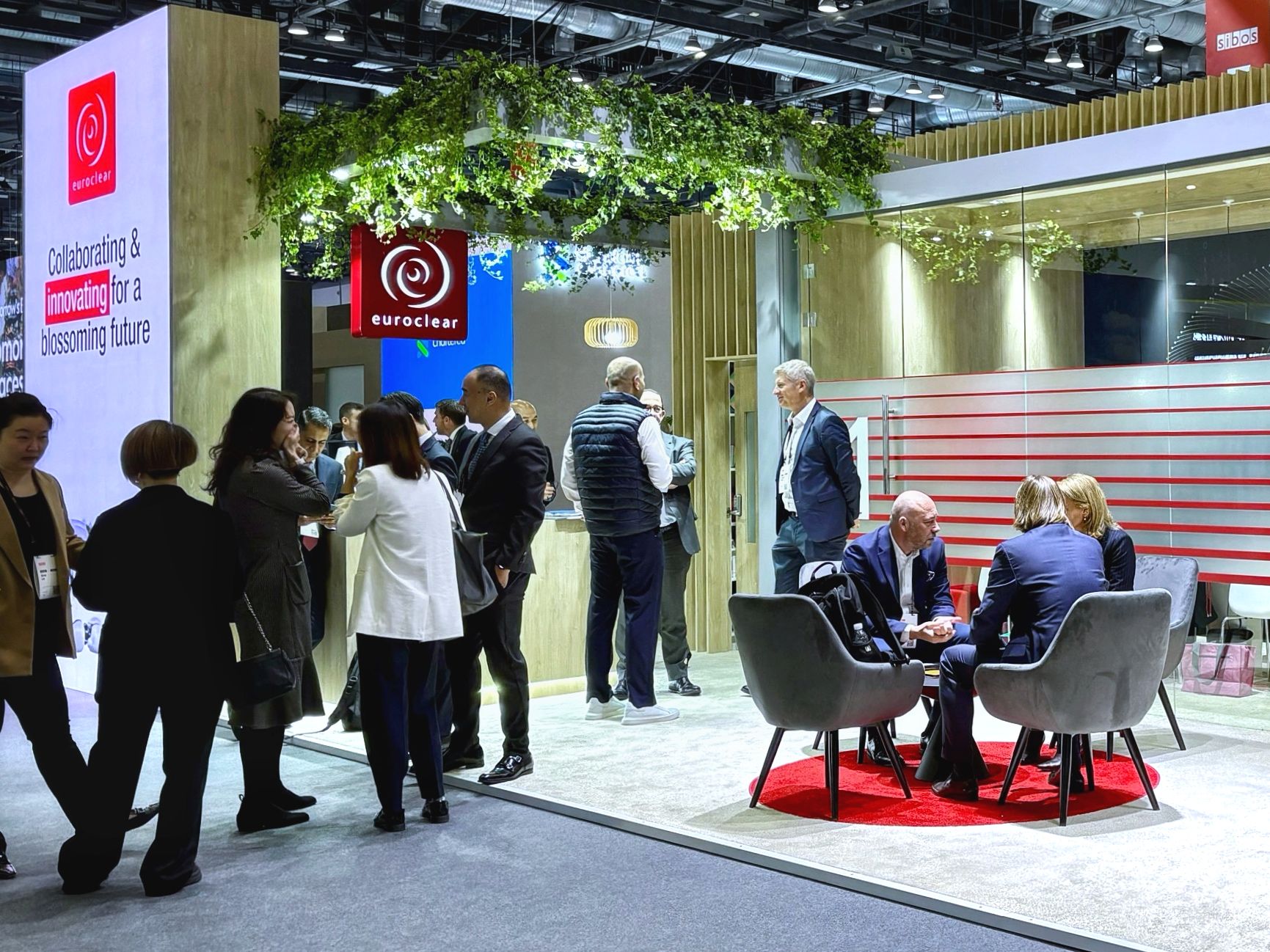

Taskize joined the global financial community at SIBOS 2024 last week in partnership with our colleagues at Euroclear

Taskize joined the global financial community at SIBOS 2024 last week in partnership with our colleagues at Euroclear to connect, collaborate and exchange ideas with our valued clients and partners – writes Interim CEO, James Pike

I was there with our Head of Commercial, Sam Gardiner, to share the latest developments in our product and partnerships – and why Taskize is Euroclear’s (among others!) preferred collaboration platform for query resolution.

Firstly, our team used the opportunity to connect with some of our key contacts face-to-face. It was great to meet Kimberley Long from The Banker in person and hear the leadership insights from her fireside chat with Wilfred Yiu, Deputy Chief Executive Officer at Hong Kong Exchanges and Clearing Limited.

As well as meeting in person, we also heard from Giles Elliott at TCS BaNCS, talking on the panel about innovating securities markets with ISO 20022.

Secondly, we joined some of the key panels featuring Taskize clients including:

Finally, we had a very productive series of sessions with our colleagues at Euroclear, Taskize’s parent company, hearing the latest insights from the panels they spoke on including:

1. Valerie Urban, CEO of Euroclear, took to the stage in a session titled ‘CEO perspectives: The future of securities market infrastructures.’

As Bernard said at Sibos: “This year, we’re [Euroclear] focusing on collaboration for the future. We’re looking at innovation, tokenisation, digital challenges, and where Euroclear can help key stakeholders or key partners across the globe.”

3. Philippe Laurensy, CEO of Asia Pacific at Euroclear participated in the panel ‘Fund tokenisation: How is DLT delivering transformational value to investors?’ – and delved into some of the most significant industry projects focused on tokenising funds, highlighting the tangible benefits and potential pitfalls of this transformative technology.

Read how Philippe describes Taskize and the value of our platform

5. Jørgen Ouaknine, Group Head of Innovation and Digital Assets at Euroclear, featured on the discussion ‘Unlocking digital assets adoption through standardisation’. This explored recent standardisation initiatives, from enhancing existing standards to developing new ones – and how these efforts are driving key benefits and identifying the critical areas the industry must focus on to achieve large-scale institutional adoption of digital assets.

6. Euroclear also hosted a roundtable with clients and partners together with The Depository Trust & Clearing Corporation (DTCC), Clearstream, and Boston Consulting Group (BCG). The discussion on Digital Asset Securities Control Principles (DASCP) highlighted the transformative potential of tokenisation in capital markets and explored the latest trends, challenges, and solutions in driving digital assets adoption.

I went straight from SIBOS to meetings with clients and prospects in Hong Kong – more of which coming in future Taskize insights.