Insights

Shaping the Future of Funds: Taskize at FundsCo 2025

Read the key trends shaping the future of funds

We recently attended InvestOps Europe, the premier conference where industry leaders share their views on the evolving landscape of investment ops.

We recently attended InvestOps Europe, the premier conference where industry leaders share their views on the evolving landscape of investment ops.

Taskize engaged with clients and peers to explore how our collaboration platform helps teams tackle the complexities of shorter settlement cycles, operational resilience, and data management.

Here are the key takeaways from six of the sessions we attended, highlighting trends that will shape the future of post-trade operations.

1.COO Panel: The target operating model of 2025 and beyond

With firms increasingly embracing cloud adoption and AI-driven automation to optimise their workflows, the panel emphasised the need for strategic flexibility to quickly adapt to changing market conditions.

Key takeaways:

2. Driving closer collaboration between cross-functional teams

Notably, Taskize was mentioned by one of the panelists as a tool that helps manage both internal and external queries, enabling smoother and more efficient collaboration across teams.

Key takeaways:

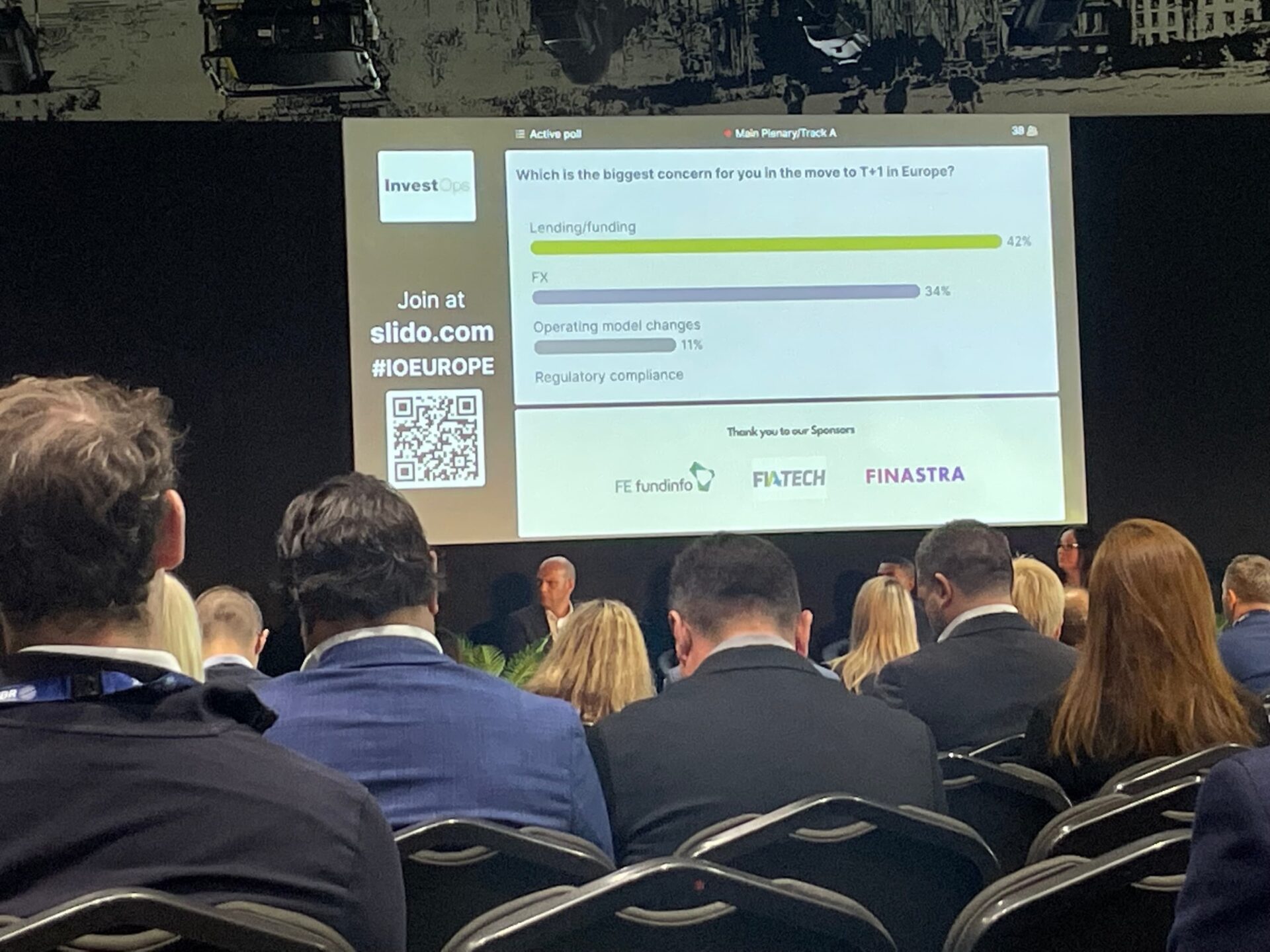

3. Meeting T+1 requirements in Europe

Europe faces unique challenges due to its multi-country regulatory frameworks and panelists stressed the importance of automation to reduce fail rates and enable teams to focus on more complex tasks.

Key takeaways:

4. Servicing multi-asset funds

…in which we explored how firms are evolving operations to support more complex, multi-asset investment products. A major challenge identified was data silos that can form when managing different asset classes. To address this, firms are turning to technology solutions that enhance data accessibility and uniformity across both public and private assets.

Key takeaways:

5. Building around the clock T+1 capabilities

Automation tools like CTM (Central Trade Manager) are being utilised to ensure seamless integration across time zones. One of the key challenges highlighted was the pressure to modernise workflows while maintaining operational resilience.

Key takeaways:

6. The pathway to T0 settlements

The panel discussed the significant technological investments required to achieve this, including a strong reliance on blockchain and distributed ledger technologies. There are still numerous challenges, particularly in foreign exchange (FX), where time zone differences and existing processes make automation difficult.

Key takeaways:

Overall, as the industry continues to adapt to new regulatory demands and market dynamics, the focus will remain on reducing complexity, improving data integration, and fostering closer collaboration across all functions.

Abbie Pontin is Relationship Manager at Taskize