People & Culture

Meet the Taskize team: Business Development

Watch the first video in our new ‘Team Voices’ series

We recently connected with clients and peers at FundsCo to demonstrate how the Taskize platform and our suite of solutions bring clarity to complex operational environments.

Our team – Jamie Sukumaran, Sam Gardiner, Simon Gibbs, and Tara Costello – exhibited and connected with clients and peers to better understand their challenges and explore how the Taskize platform can help bring clarity to increasingly complex operational environments.

From digital innovation to the emergence of private markets, this year’s conference focused on the forces reshaping the investment landscape.

Among the standout sessions was a compelling keynote by Julia Streets, who offered sharp, forward-looking insights into the role of fintech in revolutionising fund operations. Her message was clear: innovation is no longer a nice-to-have – it’s essential for staying relevant and competitive.

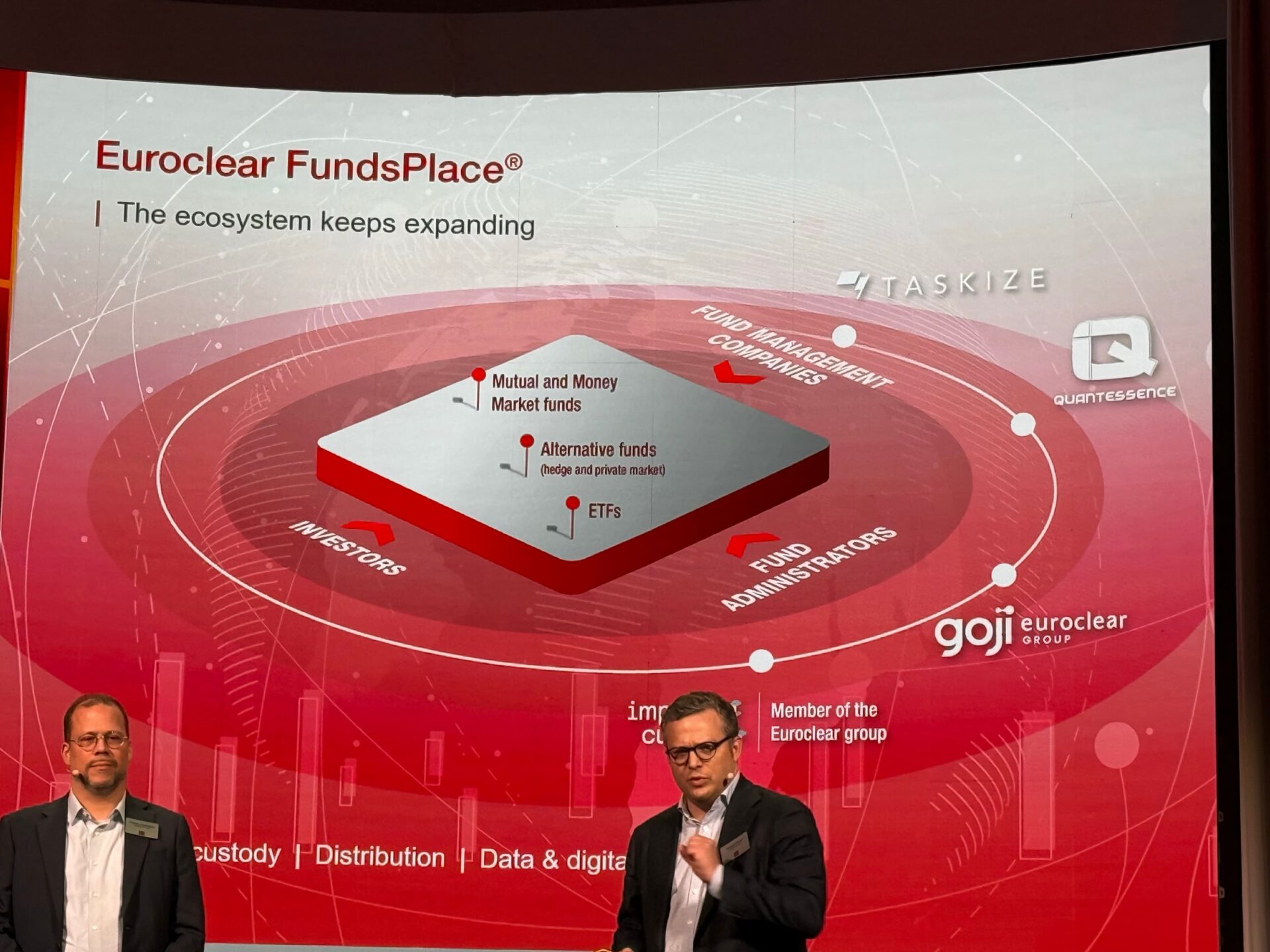

Another highlight came from Vincent Clause and Nicolas Hausseguy, both leading Euroclear’s FundsPlace strategy. They shared a future-forward vision of the Euroclear FundsPlace ecosystem, laying out how it’s positioned to redefine industry efficiency and connectivity.

Overall, technology is enabling better efficiency and broader access – but fund managers will remain essential, with their role becoming even more pivotal in navigating increasingly complex market dynamics.

1. What trends are driving the funds industry in 2025 and beyond?

Moderator: Dean Frankle, Boston Consulting Group

This panel explored the biggest forces driving the evolution of the funds business – and where the opportunities lie. Among the highlights:

2. Will tokenisation reshape the future of the funds industry?

Moderator: Anutosh Banerjee, McKinsey & Company

This forward-looking session dove into the role of distributed ledger technology and tokenisation in transforming the industry. Key takeaways included:

Moderator: Justina Deveikyte, Novantigo

Private markets continue to experience explosive growth, tripling in value every decade. This session unpacked what’s ahead: