Financial institutions can leverage Taskize’s integration with Meritsoft’s Asset Servicing Claims Manager to accelerate payment and settlement of claims and improve operational efficiencies.

Benefits:

Accelerated claim resolution

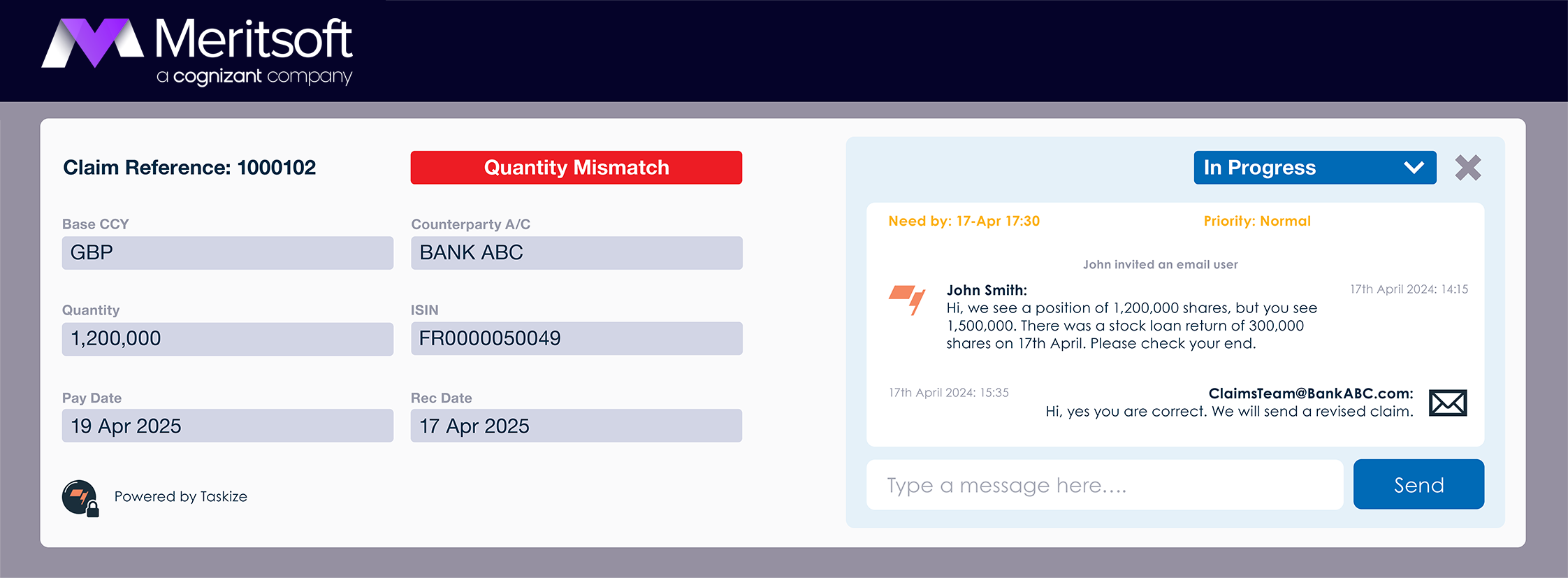

Issues such as quantity mismatches, rate differences, and missing or incorrect SSI’s.

In-platform claims management

The integration eliminates the need to switch between different systems to resolve exceptions, facilitating a more streamlined operational process.

Enhanced communication

Contact your teams and counterparties on whichever communication tool they use without leaving the Asset Servicing Claims Manager.

“Our solution empowers Asset Servicing teams globally to move away from the manually intensive processes involved with claims matching and reconciliation and focus instead on more complex and value-add tasks. For the broader firm, this will equate to lower costs, healthier margins, and an enhanced client reputation.”

Daniel Carpenter, CEO of Meritsoft

“Financial markets are becoming more complex and interconnected; as trading volumes increase, new regulations are implemented, and new markets rise to the fore. In this context, interoperability of post-trade systems is essential.

Our integration with Meritsoft is a testament to our commitment to connecting front and back-office teams, enabling the smarter allocation of work to speed up time consuming manual exception resolution tasks and, as a result, navigate the increasingly complex market environment.”

James Pike, Chief Revenue and Business Strategy Officer of Taskize

How does it work?

When a stock lending claim discrepancy is identified (e.g. a quantity difference due to a stock loan return being mis-recorded in an upstream system), users initiate a query in the Asset Servicing Claims Manager, creating a Taskize bubble to collaborate with internal teams and counterparties in real-time, ensuring timely and documented resolution.